How to Reduce Your Home Loan Amount with Prepayment

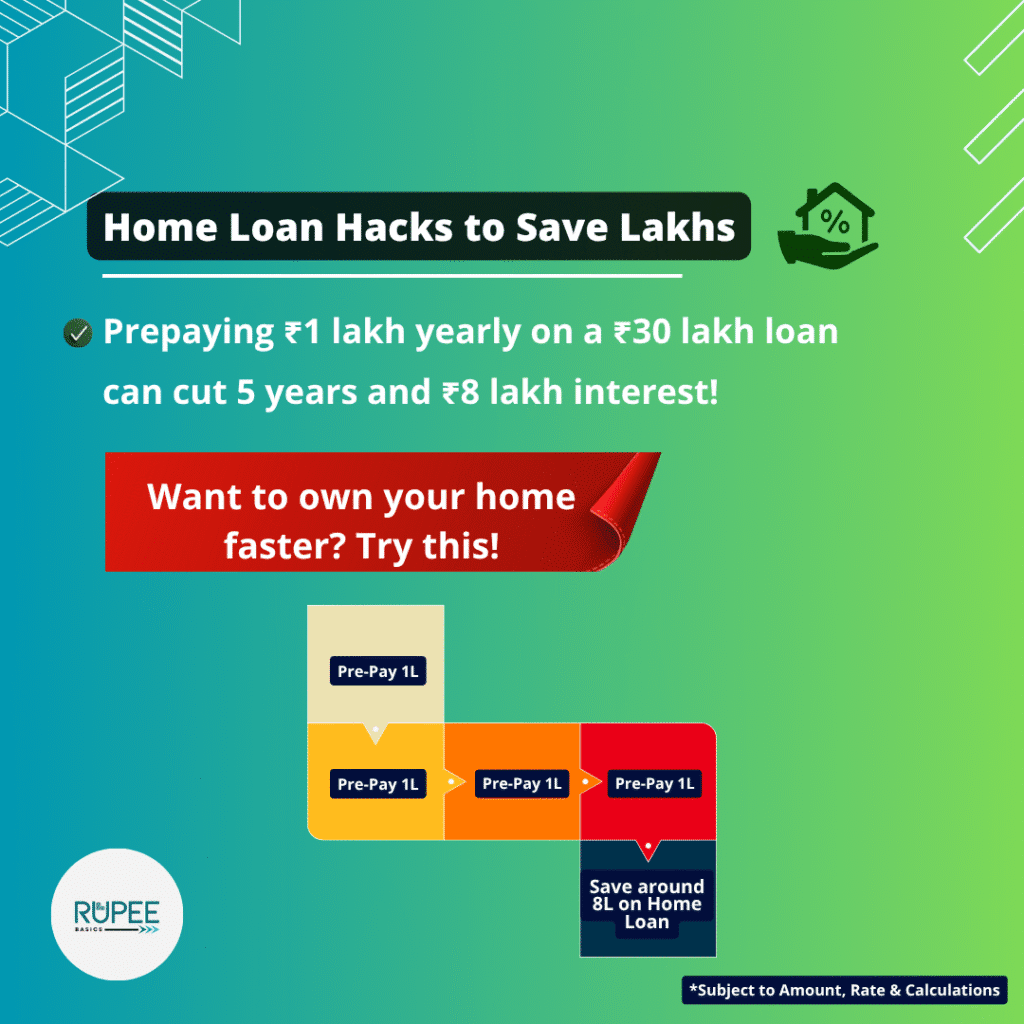

Home loans can feel like a long journey to pay loan EMIs, but there’s a smart way to lighten the load — prepayment. When you pay a little extra over your regular EMI (either as a lump sum or in parts), it goes straight to reduce your principal amount.

This means less interest over time and a shorter loan tenure. Even small prepayments made early in the loan period can save you lakhs in interest.

📊 Quick Example:

Suppose you took a home loan of ₹40 lakhs for 20 years at 8.5% interest.

Your EMI will be around ₹34,677, and total interest payable over 20 years would be about ₹43.2 lakhs.

Now, if you make a lump sum prepayment of ₹5 lakhs in the 3rd year:

- Your principal drops to ₹35 lakhs

- You could save ₹10–12 lakhs in interest

- And reduce your loan term by around 4–5 years (if you keep the same EMI)

Even periodic small prepayments like ₹50,000 once a year can lead to big savings over time.

Most banks allow partial or full prepayments without extra charges (especially for floating-rate loans), so take advantage of any extra funds — bonuses, tax refunds, or matured investments. Better to avail a home loan which has NIL prepayment charges and should also have a option to pre pay in part or in full.

Prepaying your home loan is a smart, stress-free way to save money and become debt-free faster.