Hexaware Technologies, a leading IT consulting and services firm, is set to launch its Initial Public Offering (IPO) on February 12, 2025. This event has garnered significant attention from investors eager to participate in the company’s growth.

Company Overview

Founded in 1990 and headquartered in Navi Mumbai, India, Hexaware Technologies specializes in digital transformation services across various sectors, including banking, financial services, healthcare, manufacturing, and retail. The company’s service portfolio encompasses business process outsourcing, cloud services, data and artificial intelligence services, digital IT operations, and enterprise platform services.

Financial Highlights

As of 2023, Hexaware reported an annual revenue of $1.3 billion, supported by a global workforce of approximately 32,000 employees across 54 offices worldwide. The company has demonstrated robust financial growth, new client acquisitions, and significant progress in environmental, social, and governance (ESG) goals.

Management Team

Under the leadership of CEO and Executive Director Srikrishna Ramakarthikeyan, Hexaware emphasizes putting people first, creating customer value, relentless innovation, and sustainability. These core values guide the company’s strategic decisions and operations.

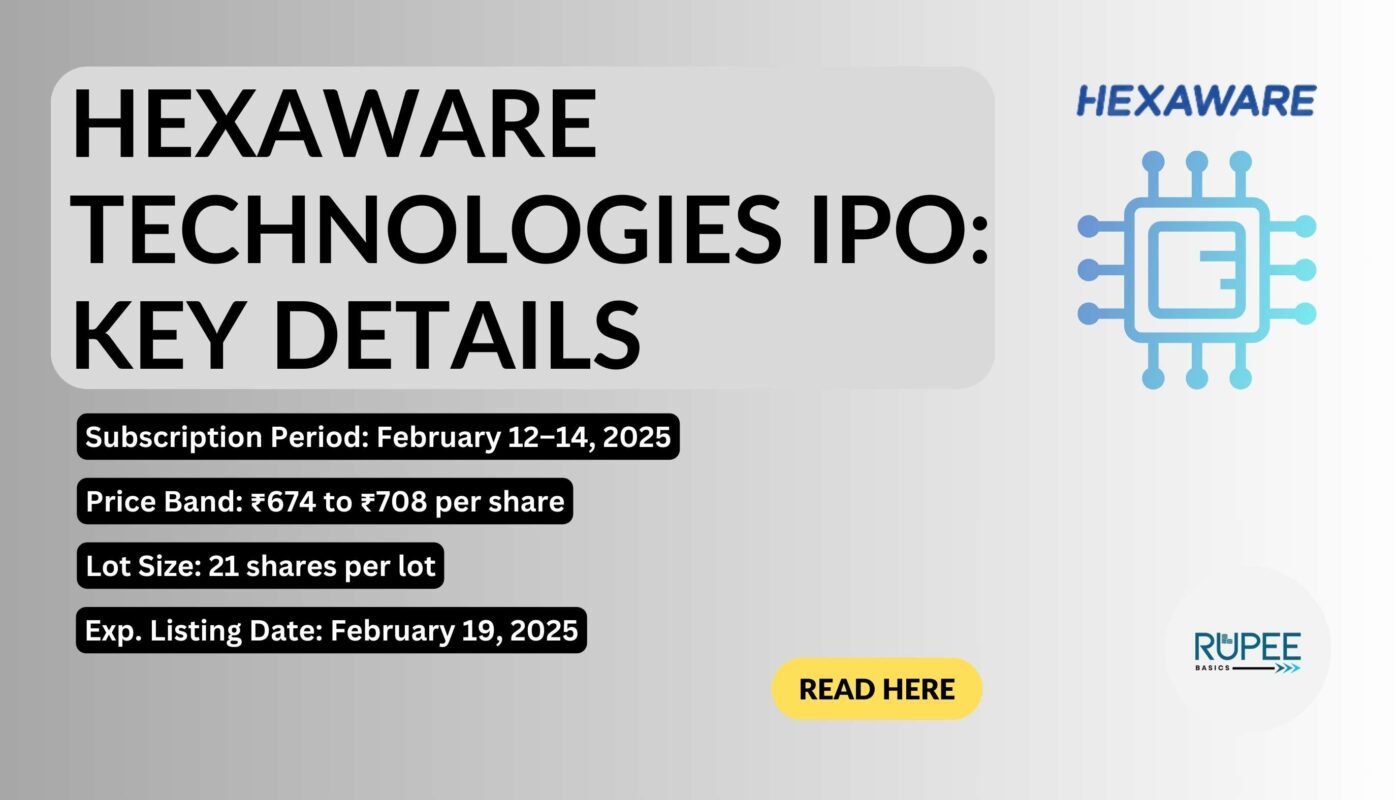

IPO Details

- IPO Dates: Opens on February 12, 2025, and closes on February 14, 2025.

- Price Band: Set between ₹674 and ₹708 per equity share.

- Lot Size: Investors can bid for a minimum of 21 shares, translating to a minimum investment of ₹14,868. citeturn0search4

- Issue Size: The IPO aims to raise ₹8,750 crore through an offer for sale of 12.36 crore existing shares. citeturn0search4

- Listing Date: Shares are expected to be listed on the BSE and NSE on February 19, 2025. citeturn0search4

Application Process

Investors can apply for the Hexaware IPO through various brokerage platforms and financial institutions.

The application process typically involves selecting the IPO, entering the desired number of lots, providing your UPI ID, and confirming the bid.

Ensure that you have a valid DEMAT account and sufficient funds in your bank account to cover the application amount. If you do not have DMAT, You can open Free DMAT A/c by Clicking here.

FAQs for Investors

- What is the objective of the Hexaware IPO?

- The IPO is an offer for sale by existing shareholders, aiming to enhance the company’s visibility and provide liquidity to current investors.

- Will Hexaware receive any proceeds from the IPO?

- No, the company will not receive any proceeds as the IPO comprises an offer for sale by existing shareholders.

- What is the Grey Market Premium (GMP) for Hexaware’s IPO?

- As of now, the GMP is approximately ₹5, indicating a potential listing price of ₹713 per share.

- How can I apply for the Hexaware IPO?

- You can apply through your brokerage platform by selecting the IPO, entering the number of lots, providing your UPI ID, and confirming the bid. Ensure you have a valid demat account and sufficient funds.

- When will the allotment be finalized?

- The share allotment is expected to be finalized on February 17, 2025.

Additional Information

Hexaware Technologies has a strong presence in the IT consulting and services sector, offering a range of solutions that cater to various industries. The company’s commitment to innovation and customer satisfaction has been a driving force behind its growth. With the upcoming IPO, Hexaware aims to further solidify its position in the market and provide value to its shareholders.

Disclaimer

Investing in IPOs involves risks, including market volatility and the potential loss of capital. Prospective investors should carefully read the Red Herring Prospectus and consult with financial advisors before making investment decisions. Past performance is not indicative of future results.

“Energy flows where attention goes.” – Tony Robbins