Depreciation Rates as per Companies Act 2013

Depreciation is an important accounting concept that helps businesses allocate the cost of an asset over its useful life. The Companies Act 2013 provides specific depreciation rates for different assets under Schedule II, ensuring a uniform method for calculating asset depreciation in financial statements.

What is Depreciation?

Depreciation is the gradual reduction in the value of an asset due to wear and tear, passage of time, or obsolescence. Companies use depreciation to spread the cost of an asset over its useful life instead of deducting it all at once. This helps in reflecting the true financial position of the company and also assists in tax planning.

Methods of Depreciation under the Companies Act 2013

There are two commonly used methods of depreciation:

- Straight Line Method (SLM) – Under this method, the asset depreciates equally over its useful life. This means the depreciation expense remains constant every year. It is simpler and commonly used in industries where asset usage is relatively uniform over time.

- Written Down Value Method (WDV) – In this method, the asset depreciates at a fixed percentage on its reducing balance every year. The depreciation charge is higher in the initial years and reduces as time progresses. This is beneficial for assets that lose value more rapidly in the initial years of usage.

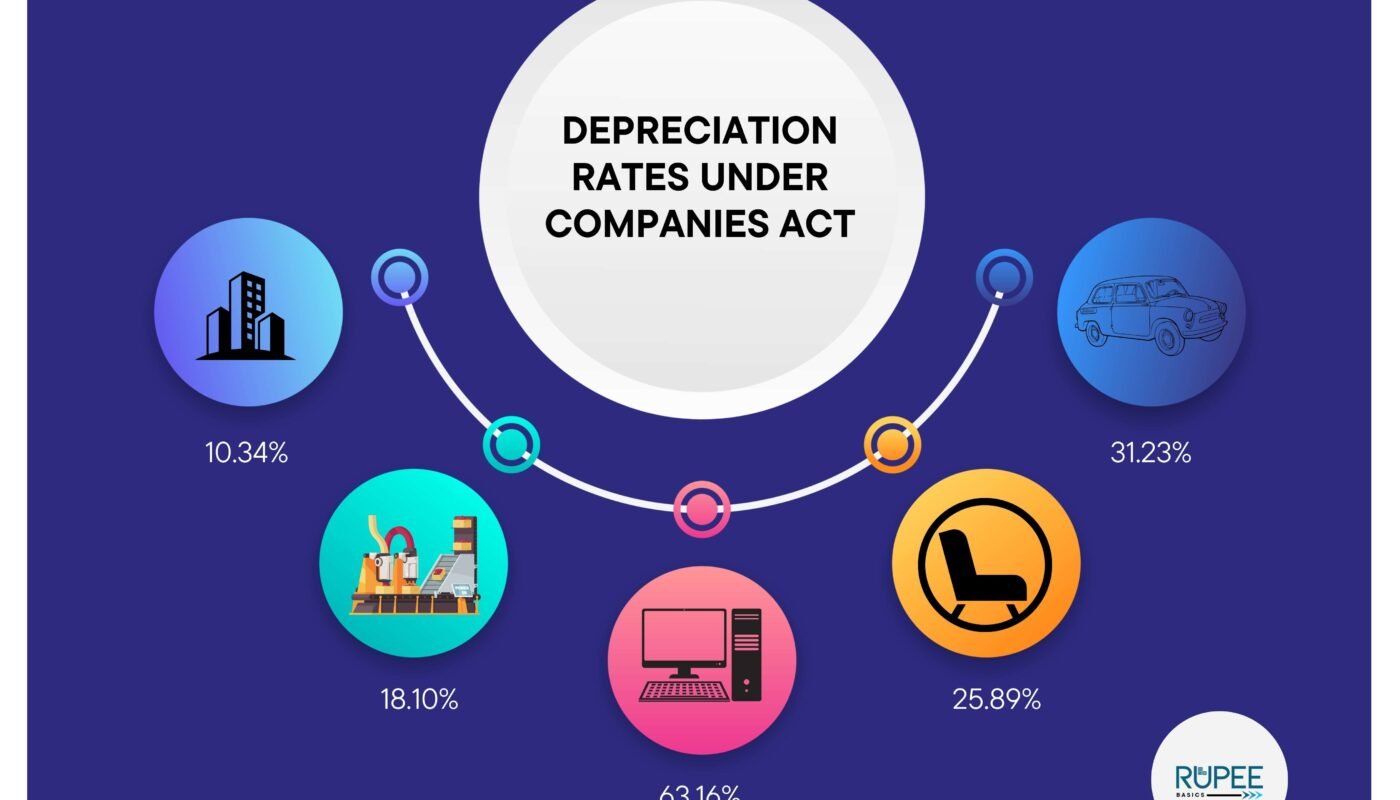

Depreciation Rates as per Schedule II of the Companies Act 2013

Below is a simplified table of depreciation rates for different types of assets along with a detailed description of each:

| Asset Category | Useful Life (Years) | Depreciation Rate (SLM) | Depreciation Rate (WDV) | Detailed Description |

|---|---|---|---|---|

| Building – Factory | 30 | 3.17% | 10.34% | Industrial and factory buildings used for production, manufacturing, and operations. |

| Building – Non-Factory | 60 | 1.67% | 5.28% | Residential or office buildings, including commercial premises used for administrative purposes. |

| Plant & Machinery – General | 15 | 6.33% | 18.10% | Machinery used in factories for production, including automated systems, conveyor belts, and heavy-duty equipment. |

| Computers and Software | 3 | 31.67% | 63.16% | Includes desktops, laptops, and software essential for business operations, including ERP and financial software. |

| Furniture & Fixtures | 10 | 9.50% | 25.89% | Includes office furniture, wooden and metal chairs, tables, cabinets, and interior fittings. |

| Vehicles – Motor Cars | 8 | 11.88% | 31.23% | Passenger cars used for business purposes, including company-owned employee transport and sales vehicles. |

| Vehicles – Trucks, Buses | 6 | 15.83% | 39.30% | Commercial vehicles such as trucks and buses used for logistics, distribution, and employee transportation. |

| Office Equipment | 5 | 19.00% | 45.07% | Includes office appliances like printers, scanners, telephones, air conditioners, and security systems. |

Frequently Asked Questions (FAQs)

1. Why is depreciation important?

Depreciation helps businesses allocate asset costs properly, reducing tax liabilities and ensuring accurate financial reporting. It also helps in assessing the correct book value of an asset at any given time.

2. How to choose the correct depreciation rate?

To select the correct depreciation rate, first identify the asset category from Schedule II of the Companies Act 2013 and choose the applicable rate based on your preferred method (SLM or WDV).

3. Can depreciation rates change?

Yes, depreciation rates may be updated based on amendments to the Companies Act or new government policies. It is advisable to stay updated with regulatory changes and refer to the latest provisions.

4. What happens if an asset is sold before its useful life ends?

If an asset is sold before completing its useful life, the remaining depreciation is adjusted in the profit & loss account, and any gain or loss is recorded accordingly in financial statements.

5. Are intangible assets covered under depreciation?

Yes, intangible assets such as patents, trademarks, and goodwill are also subject to amortization, which is similar to depreciation but applicable to non-physical assets.

Conclusion

Understanding depreciation rates as per the Companies Act 2013 is essential for accurate financial management. Choosing the correct depreciation method and rate ensures compliance with accounting standards and tax laws. Businesses should refer to Schedule II for updated depreciation guidelines and apply them appropriately in their financial statements to maintain transparency and accuracy.

“You attract what you are, not what you want.”

📢 Need Expert Help with Finance & Taxation?

Get professional assistance on Taxation, Business Registration & Compliance. 🔗 Contact Us for expert guidance! 🚀